October 3, 2013. With the federal government partially shut down and the debt limit crisis two weeks away, this could very well be the final song for the United States of America as we know it. Last month, Poland quietly confiscated private retirement accounts. Cyprus did the same to private savings accounts. MF Global did the same to American depositors. And many are warning the US is about to nationalize all US retirement accounts.

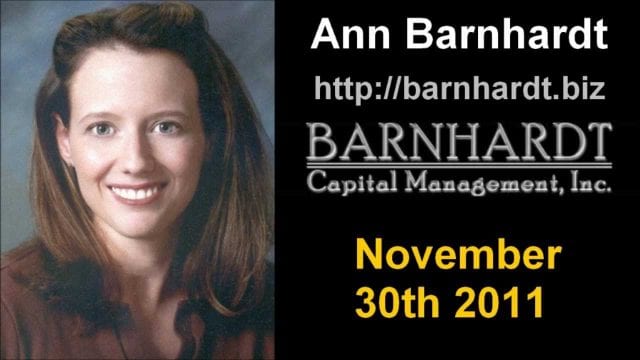

One of the most outspoken financial analysts warning of the impending collapse of the United States is Ann Barnhardt. With fire and brimstone in her lecture, she warns of a crippled US government at the mercy of an out-of-control global economy. With Americans on the hook for trillions of dollars, Barnhardt describes in plain English what the rich and powerful are already doing to get their money back from the American people. And you’re not going to like it.

Confiscation of all bank accounts

It’s no conspiracy theory. It’s happening all around us, including here in the United States. In March, the government in Cyprus shocked the world when it announced one morning that over the weekend, the country had confiscated private savings accounts to pay some of the country’s national debt obligations and avoid harsh austerity measures against the poor and the riots that would surely follow.

Last month, Poland did the same thing. Except the Polish government only helped itself to 50% of all private retirement and pension accounts. This, they said, was an emergency measure to halt a possible collapse of the Polish economy under the unbearable weight of its national debt. And just within the last few weeks, other countries have rushed to declare their right to do the same, including Canada, New Zealand, the European Union, Iceland, Italy and more every day.

The American crisis

The US national debt is officially $16 trillion. But if we add in future payments for debts America has already incurred, that number is rapidly approaching $100 trillion. Consider this fact – Americans have $20 trillion dollars sitting in their public and private retirement and pension accounts. Make no mistake about it, Congress and the President are salivating at the thought of getting their hands on that money.

In fact, some are whispering that a coming bipartisan national retirement savings program will be introduced to replace the retirement portion of Social Security. They’re also whispering that the new program will be funded by the nationalization, or confiscation if you like, of all public and private US pensions, annuities and retirement accounts.

Enter Ann Barnhardt

Not long ago, we at Whiteout Press stumbled across a YouTube video of a lecture by financial analyst Ann Barnhardt. Except for the rare mention of religion, this author was riveted by not only her grasp of the seldom-reported crisis here in the US, but also her blunt, easy to understand explanations for why America is about to go through the most horrific and painful time in its history. And we will never see America as we know it again.

In her written documentation, Barnhardt begins her 2.5 hour lecture with a couple universally accepted facts. One of those is the extent by which four multi-national banks have taken over the US economy. She points out that all US banks combined are holding $223 trillion in investment derivatives. JP Morgan, Goldman Sachs, Citigroup and Bank of America together account for $208 trillion of that. While that fact is shocking in its own right and the evidence that ‘too big to fail’ is alive and well, it’s nothing compared to what the four banks have set aside to cover those potential losses.

Bank – Exposure – Set Aside

JP Morgan – $69 trillion – $147 billion

Citibank – $55 trillion – $136 billion

Bank of America – $42 trillion – $140 billion

Goldman Sachs – $41 trillion – $21 billion

Ann Barnhardt also points out that the combined value of all assets, public and private, in the United States is $217 trillion. That, in the real world, is when America’s credit runs out because it no longer has anymore collateral to put up against its never ending borrowing. Over the last two years, the Federal Reserve has solved that problem by simply printing trillions of dollars in soon-to-be worthless US Dollars. But that trick will only hold up as long as the Ponzi scheme that is the US economy stays afloat.

Confiscation of all bank accounts

It’s no conspiracy theory. It’s happening all around us, including here in the United States. In March, the government in Cyprus shocked the world when it announced one morning that over the weekend, the country had confiscated private savings accounts to pay some of the country’s national debt obligations and avoid harsh austerity measures against the poor and the riots that would surely follow.

Last month, Poland did the same thing. Except the Polish government only helped itself to 50% of all private retirement and pension accounts. This, they said, was an emergency measure to halt a possible collapse of the Polish economy under the unbearable weight of its national debt. And just within the last few weeks, other countries have rushed to declare their right to do the same, including Canada, New Zealand, the European Union, Iceland, Italy and more every day.

The American crisis

The US national debt is officially $16 trillion. But if we add in future payments for debts America has already incurred, that number is rapidly approaching $100 trillion. Consider this fact – Americans have $20 trillion dollars sitting in their public and private retirement and pension accounts. Make no mistake about it, Congress and the President are salivating at the thought of getting their hands on that money.

In fact, some are whispering that a coming bipartisan national retirement savings program will be introduced to replace the retirement portion of Social Security. They’re also whispering that the new program will be funded by the nationalization, or confiscation if you like, of all public and private US pensions, annuities and retirement accounts.

Enter Ann Barnhardt

Not long ago, we at Whiteout Press stumbled across a YouTube video of a lecture by financial analyst Ann Barnhardt. Except for the rare mention of religion, this author was riveted by not only her grasp of the seldom-reported crisis here in the US, but also her blunt, easy to understand explanations for why America is about to go through the most horrific and painful time in its history. And we will never see America as we know it again.

In her written documentation, Barnhardt begins her 2.5 hour lecture with a couple universally accepted facts. One of those is the extent by which four multi-national banks have taken over the US economy. She points out that all US banks combined are holding $223 trillion in investment derivatives. JP Morgan, Goldman Sachs, Citigroup and Bank of America together account for $208 trillion of that. While that fact is shocking in its own right and the evidence that ‘too big to fail’ is alive and well, it’s nothing compared to what the four banks have set aside to cover those potential losses.

Bank – Exposure – Set Aside

JP Morgan – $69 trillion – $147 billion

Citibank – $55 trillion – $136 billion

Bank of America – $42 trillion – $140 billion

Goldman Sachs – $41 trillion – $21 billion

Ann Barnhardt also points out that the combined value of all assets, public and private, in the United States is $217 trillion. That, in the real world, is when America’s credit runs out because it no longer has anymore collateral to put up against its never ending borrowing. Over the last two years, the Federal Reserve has solved that problem by simply printing trillions of dollars in soon-to-be worthless US Dollars. But that trick will only hold up as long as the Ponzi scheme that is the US economy stays afloat.

The Economy is Going to Implode

‘The Economy is Going to Implode…And You Deserve to Understand Why,’ that’s the opening statement by Ann Barnhardt from her eye-opening lecture. Among a number of specific topics and examples, she illustrates the actual problem with the liabilities the above four banks have. If the US economy collapses, the banks will go down first with the US government quickly following.

Documenting why private savings accounts will be one of the first US assets seized, Barnhardt explains that Americans currently have roughly $10 trillion in their bank accounts. The FDIC, which ‘guarantees’ all accounts up to $250,000 – only has $11 billion on hand to cover that. “When the banking system collapses, you will pay for it one way or another,” she warns Americans.

“The banking paradigm just shown exists all over the world,” Ann Barnhardt continues, “The entire global economy is a giant debt bubble propped up by massive de facto currency counterfeiting and hot air.” She goes on to describe exactly how the collapse of the US economy will happen.

The US collapse

After explaining how the entire global economy is an unpayable debt bubble, Barnhardt continues by documenting how the US economy has its own debt bubble and how it’s about to burst. Quoting a small portion of her lecture, she explains:

“Exactly the same thing is happening in the US with US Treasury paper being bought by the Federal Reserve as the US government runs up massive debt and bails out banks. When US interest rates uptick, the last vestiges of the now-dead Republic will implode. This is a mathematical inevitability.

Obama alone, and it isn’t just Obama. Don’t get me wrong. I’m not some George W. Bush fan girl standing here. No way. But the damage that Obama has done, that regime has done, is so massive, and it was consciously done. The damage that that has done, and the amount of new debt, and remember guys, that debt was issued in basically a zero-interest rate environment. So that’s your starting point. Zero percent interest.

If there’s any uptick in interest rates, if the Federal Reserve basically loses its grip on the markets, and the actual interest rate market is allowed to emerge in the United States, just having the interest rate uptick from zero percent to three percent, which three percent is historically extremely low, just going from zero to three – that will mathematically implode the entire system.”

Considering the above excerpts and descriptions only cover the first half of Ann Barnhardt’s 2.5 hour lecture, readers will be shocked even more when they discover some of the other little-known facts about the US economy and its near-destruction. And as we mentioned above, if readers can overlook the couple brief references to Judeo-Christian fundamentalist theology, Barnhardt’s presentation is as captivating as it is educational.

Watch the full video at YouTube.

Recent Whiteout Press articles:

Feds admit abusing NSA Spy Authority for stalking

Talks show US to occupy Afghanistan indefinitely

First GOP Presidential Straw Poll reveals 2016 Field