Credit management is a fundamental aspect of personal finance that individuals should master to achieve financial stability. The debt can be overpowering, so numerous individuals discover themselves struggling to make ends meet. Debt calls from leasing agents or collection offices are upsetting. In such a case, learning how to oversee such calls and maintain a strategic distance from harassment is crucial to maintain great monetary health.

Midland Credit Management is one of the greatest debt-collection businesses in the United States. They utilize aggressive tactics, driving numerous buyer complaints. If you have been a victim of Midland Credit phone harassment, you must know that you are not alone. It is crucial to know your rights as a consumer and learn how to bargain with the collectors to preserve a key distance from harassment.

This article talks about credit management tips for managing debt calls and dodging harassment.

Dealing With Credit Management: Tips And Strategies

Know Your Rights As A Consumer

The Fair Debt Collection Practices Act (FDCPA) was sanctioned to ensure customers from out-of-line collection practices. The law outlines particular rules that collectors must take when endeavoring to gather a debt. For example, they cannot call you before 8:00 am or after 9:00 pm, and they cannot utilize threatening or damaging language.

If you have been a victim of Midland Credit phone harassment, you ought to know that you have rights. These collectors are not permitted to utilize misleading, deceiving, or out-of-line strategies. They cannot threaten to sue you, embellish your compensation, or take other lawful activity unless they propose to do so.

Respond To Debt Calls

Ignoring debt calls will not make them go absent. In reality, it may lead to more forceful collection strategies. Instead, it would be best if you reacted to such calls instantly. When a collector calls, inquire for their name, the title of the company they represent, and the sum of the debt they are attempting to collect.

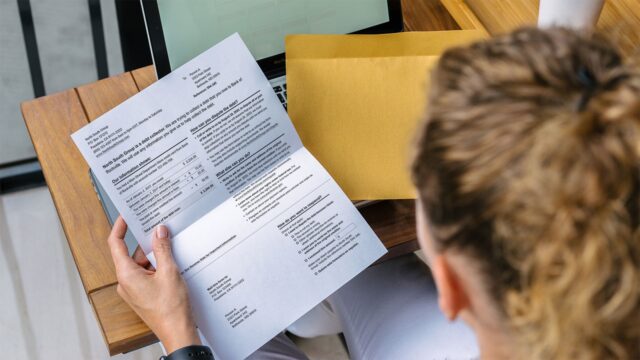

Once you have got this data, inquire the collector to send you a written approval notice within five days. The approval notice ought to incorporate the sum of the debt, the title of the lender, and an explanation of your rights beneath the FDCPA.

Negotiate an Installment Plan

If you owe a debt, you will be able to arrange an installment plan with the creditor or the collector. This will assist you to avoid advance harassment and harm to your credit score. When arranging a payment plan, be realistic about what you can afford to pay each month.

If you’re incapable of forming installments, you may need to consider debt consolidation or debt settlement. Debt consolidation includes combining all of your debts into one loan with a lower interest rate. Debt settlement includes arranging along with your banks to settle your debts for less than the total sum owed.

Understanding Debt Calls: From What They Are And Why They Take Place

Debt calls are made by leasing agents endeavoring to gather installments for debts. This type of call is started by the first leaser or another office that got the debt from the initial creditor.

The reason is to remind indebted persons of their exceptional debts hence empowering them to make installments. These calls are persistent and may happen at different hours per day. Collectors can utilize many strategies to gather debt, including threats, intimidation, and deception.

It is critical to observe the fact that the collectors take after particular rules when reaching indebted individuals. A government law, the Fair Debt Collection Practices Act (FDCPA) , traces these laws and forbids a few sorts of practices.

Some of the limitations forced by the FDCPA include:

- Prohibiting collectors from reaching indebted individuals before 8 am or after 9 pm.

- Banning collectors from making dangers, utilizing foulness, or engaging in damaging language.

- Requiring collectors to recognize themselves and the company they speak to when reaching debtors.

- Mandating that collectors give composed approval of the debt upon request.

Despite these confinements, numerous collectors still engage in forceful strategies that can be scary and unpleasant for indebted individuals. It’s critical for indebted individuals to understand their rights and to know how to bargain with such calls in a manner that secures their interests.

If you get any such call, it’s imperative to stay calm and assertive. Inquire for the name of the caller, the title of the company they represent, and the sum of the debt they are attempting to collect. Ask that they give composed approval of the debt and take up any necessary documentation.

Additionally, it’s critical to keep point by point records of any calls you get, counting the time, date, and nature of the call. In case collectors damage your rights under the FDCPA, you will have a lawful response and may be able to seek damages.

Understanding such calls and the rights managed by indebted individuals beneath the FDCPA is a fundamental angle of credit management. By knowing your rights and how to deal with these calls, you will secure yourself from harassment and accomplish money related stability.

Conclusion

Conclusion, credit management is a basic part of individual funds, and managing debt calls can be upsetting. In any case, it is vital to know your rights as a customer and learn how to bargain with debt collectors to dodge harassment. In case you have been a victim of Midland Credit phone harassment, you ought to know that you just have rights under the FDCPA.

Remember, disregarding these calls will not make them go absent. React to the calls promptly, and inquire for a composed approval notice within five days. Negotiate an installment plan that works for you, and if you are unable to form installments, consider obligation consolidation or obligation settlement.

By taking these credit management tips, you will secure yourself from forceful collectors and accomplish money-related steadiness.